Tampa Bay New Home Finders

The Truth About Buyer Broker Commissions

Get ready for a game-changer in the real estate world starting July 2024! Amidst talks and headlines about shifting norms in real estate agent commissions, it's crucial to understand how these changes will impact you as a buyer. The truth and the myths.

In the past, sellers signed agreements specifying total commissions, a portion allocated to the buyer's agent. This evolved in the '90s to ensure buyer representation, but with fixed commissions regardless of agent experience or effort.

Come July 2024, MLS listings won't display commission offers upfront, reshaping negotiations. Buyer brokers will explore various compensation forms, ensuring flexibility and consumer choice.

What does this mean for you, the buyer?

Firstly, signing a buyer broker agreement before viewing homes has been a standard for our Brokerage. This ensures transparency in services and compensation, empowering you to assess agent value. The Buyer Broker Agreement offer opportunities for informed decision-making. Research your agent's expertise and offerings beyond door-opening services. Whether you're a seasoned buyer or a first-timer, finding the right agent enhances your experience.

Remember, the real estate landscape is evolving. Stay informed, scrutinize your options, and demand excellence from your agent. After all, your home purchase deserves nothing less.

Purchasing a home, whether it is a new construction or an existing home requires more than opening a door to show you the home. For a home buyer beyond finding the perfect home, it includes communication with the seller/builder, lender, deed restriction questions (HOA), re-estimate of taxes with transfer of property, transaction deadlines, inspections, and more.

In the current landscape of real estate, now it will also include negotiation regarding using a buyer's agent. Many first-time buyers are unaware of the impending adjustments and how they could impact negotiations.

The Myth's

"It is now illegal for Sellers to pay a Buyer's Agent."

"I am telling my Sellers not to pay a Buyer's Agent to save them money."

"Co-op commissions are prohibited now!"

"Don't worry about the lawsuit at all. It's going to go away."

The Truth's

It has never been a standard nor is it now illegal for Sellers/Builders to pay a Buyer's Agent.

Seller's/Builders still have the option of paying an agent to bring a ready, able, and willing buyer to the closing table.

The lawsuit is not going away. They changes in the industry are still evolving, but the end result will still be a change in in business practices.

The reality is that buyer's still have two options.

1. Go it alone and handle the transaction directly with the Seller/Builder/ or listing agent. (I do not recommend this obviously.)

2. Interview and "hire" a Buyer's Agent to represent them in the purchase process.

The Difference:

Going it alone on the surface may seem like the least expensive option. That is not always the case.

Hiring a reputable, experience buyer's Agent can actually save you money, time, and stress. All three are vital!

Recently, I had a client who had a home to sell in order to purchase a new construction home. Some of the vital items to understand:

1. New build was 6 months out

2. In order to be approved by builder financing had to sell immediately. Resulting in being "homeless" for 4-6 months.

By working with a new construction specialist, I was able to find financing that still allowed the buyer to take advantage of the builder incentives without using their in house lender (lender did not offer the type of financing) that also allowed them to not list their home until sixty days prior to closing on the new home.

This saved the buyer money, time, and stress in the process. This is just one example of why having an agent is vital.

Buyer Brokerage Compensation.

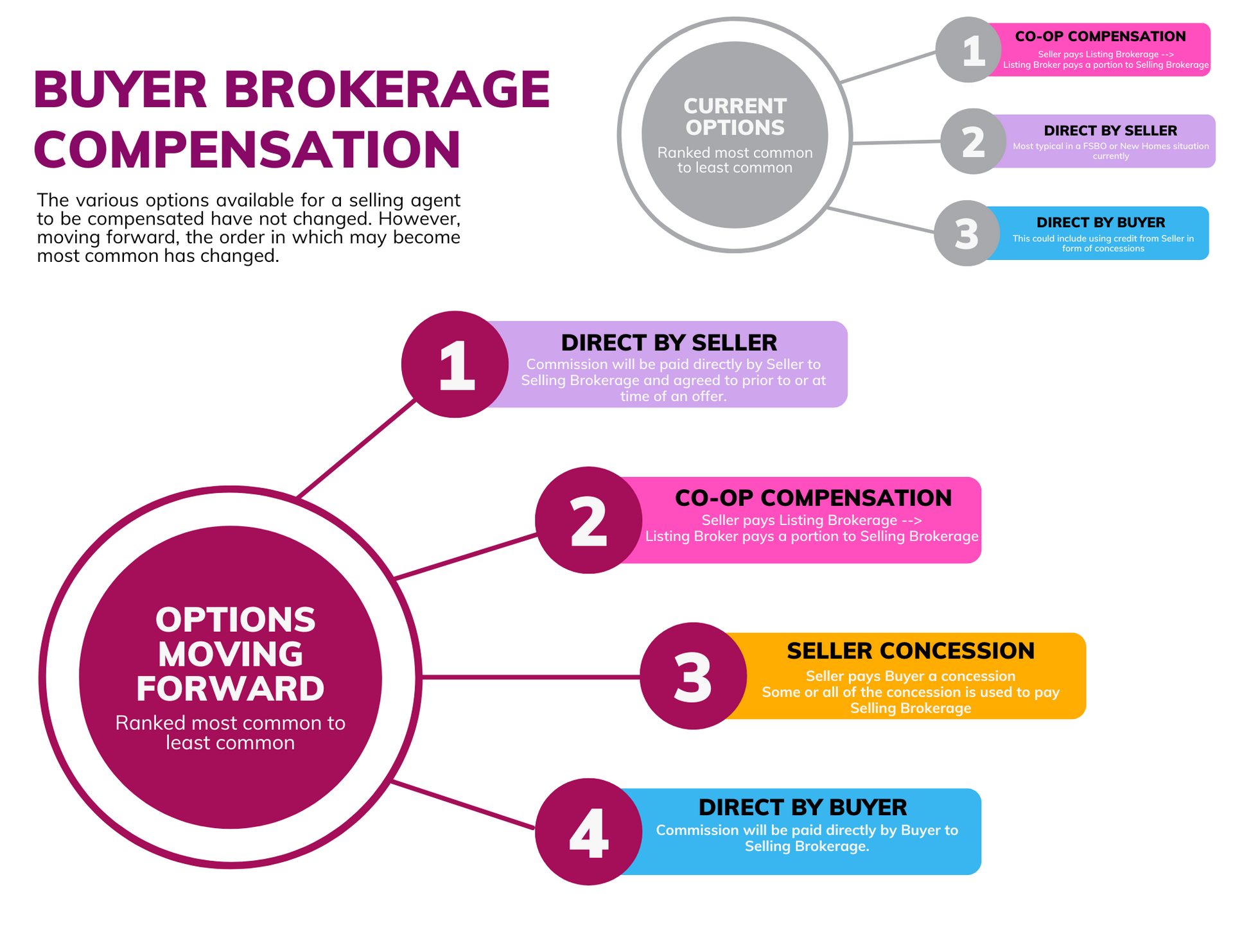

The truth is the various options available for a buyer's agent to be compensated have not changed. What has changed?

1. The order in which that compensation most potently is paid.

2. Buyer agent compensation will no longer be listed on the MLS. It is, as it always has been, negotiated at the time of the contract.

3. Buyer agents MUST have a Buyer Broker Agreement in place that states the amount of compensation for services is stated.

While this might sound complicated, it really isn't. Simply put, you the buyer still have two choices. Hire representation or go it alone.

The value in the representation is beyond a percentage number. It is having someone to negotiate, watch your back (for when the AC is stolen the night before closing), explain inspection reports (what are toe nails missing?), and more.

Our team of agents has decades of combined experience. We have agents who specialize specifically in new construction. If you would like to discuss the value of hiring us to work on your behalf in your new home purchase, please reach out today.

To learn more about the new construction opportunities in the Greater Tampa Bay Area, visit here!

If you are considering purchasing a new construction home and would like to ask questions, schedule a discovery call today with one of us or our designated New Home Specialists.

Carla Goddard | East Pasco Living Team Lead | Operations Director Builder Services

Graduate, REALTOR® Institute | Residential Specialist | BHHS-Certified New Home Specialist | Certified National Home Specialist – Residential Construction Certified (CNHS-RCC) | NHCB Certified New Homes Co-Broker |BHHS-Certified eCertified® Specialist | BHHS-Certified rCertifiedSM Referral and Relocation Specialist | Tampa Bay Builder Services Manager

📧email: carla@eastpascoliving.com

📲text/call 813.716.4498

If you are considering purchasing a new construction home and would like to ask questions, schedule a discovery call today with one of us or our designated New Home Specialists.

Carla Goddard | East Pasco Living Team Lead | Operations Director Builder Services

Graduate, REALTOR® Institute | Residential Specialist | BHHS-Certified New Home Specialist | Certified National Home Specialist – Residential Construction Certified (CNHS-RCC) | NHCB Certified New Homes Co-Broker |BHHS-Certified eCertified® Specialist | BHHS-Certified rCertifiedSM Referral and Relocation Specialist | Tampa Bay Builder Services Manager

📧email: carla@eastpascoliving.com

📲text/call 813.716.4498

Follow us